How to Generate GST Invoices in TallyPrime Easily?

Introduction

In business accounting, ensuring compliance with tax regulations is crucial. Generating GST invoices in TallyPrime is a task that many businesses find necessary but often complex. TallyPrime, an upgraded version of the popular Tally software, streamlines this process, making it simpler and more efficient. This blog will guide you through generating GST invoices in TallyPrime, providing easy-to-follow steps and addressing some common queries.

Understanding GST in TallyPrime

GST (Goods and Services Tax) is a unified tax based on the value addition at each stage. In TallyPrime, GST features are robust and designed to handle all your GST billing, filing, and reporting needs. The software automatically calculates the correct tax rates for various products and services according to the GST rules set by the government. It also updates these rates as per the latest laws, ensuring compliance and reducing the chances of errors.

How to Generate GST Invoice in TallyPrime:

Generating a GST invoice in TallyPrime is straightforward if you follow these steps:

Download Free 90+ Tally Shortcut Keys

1. Open TallyPrime: Start by launching the TallyPrime software on your computer.

2. Go to ‘Gateway of Tally’: Select ‘Vouchers’ from the main menu.

3. Access ‘Sales Voucher’: Navigate to ‘Create’ under ‘Vouchers’ and choose ‘Sales’.

4. Choose the Right Template: Ensure the voucher is in ‘Invoice Mode’. You can switch between modes by pressing ‘Ctrl+V’.

5. Enter Customer Details: Input the customer’s name, address, and GSTIN along with other relevant details.

6. Add Items: Enter the product name, description, quantity, and rate. Tally Solutions will calculate the tax applicable automatically based on the product’s GST slab.

7. Check Tax Breakup: Press ‘Alt+A’ to view the tax breakup. This shows you how much GST is being charged on each item.

8. Finalize the Invoice: After reviewing, press ‘Ctrl+A’ to accept and save the invoice.

9. Print or Email: Finally, you can print or email the invoice directly from TallyPrime by accessing the print and email options.

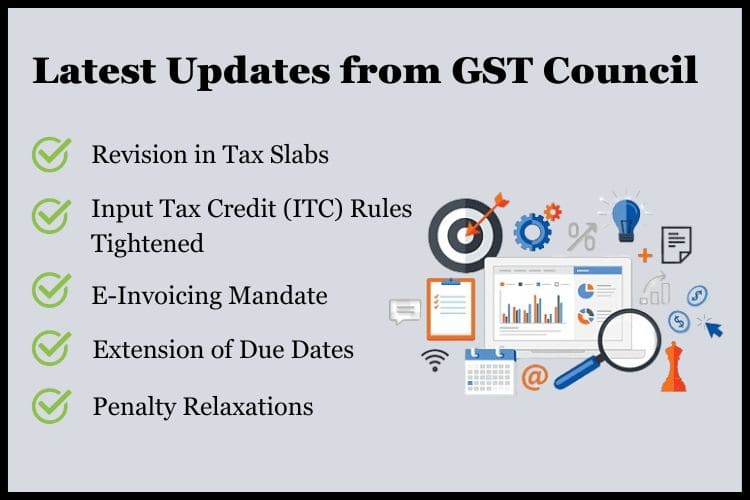

Latest Updates from GST Council

1. Revision in Tax Slabs

Recently, the GST Council reduced the number of tax rates to streamline the tax structure. This adjustment aims to make it simpler for businesses to comply with tax laws by providing them with a clearer understanding of and ability to apply the appropriate tax rates. The new structure is anticipated to reduce administrative workloads and boost overall tax administration effectiveness.

2. E-Invoicing Mandate

E-invoicing has been made mandatory for all business-to-business (B2B) transactions for enterprises whose turnover exceeds a certain threshold by the GST Council. The goal of this project is to boost business transaction transparency and enhance the accuracy of tax filings. E-invoicing will reduce the possibility of tax avoidance and enable improved tax compliance.

3. Extension of Due Dates

The COVID-19 pandemic has caused delays, hence the GST Council has extended the deadlines for filing GST returns. With more time to prepare and file their tax returns without incurring late submission penalties, businesses that have been negatively impacted financially by the pandemic may benefit from this action.

4. Penalty Relaxations

The GST Council voted to reduce the fines for late GST files in recognition of the difficulties faced by businesses, particularly during recessions. The goal of this policy is to lessen businesses’ financial responsibilities during lean times by encouraging voluntary compliance with tax laws without the threat of severe fines.

5. Input Tax Credit (ITC) Rules Tightened

The GST Council strengthened the regulations governing Input Tax Credit (ITC) applications to prevent collecting taxes and guarantee correct tax compliance. To claim ITC, businesses must now follow enhanced documentation and compliance requirements. To preserve the integrity of the tax system, only valid and confirmed claims must be handled.

Conclusion

Businesses now find it easier to comply with GST laws because of TallyPrime’s simplified GST invoice creation. The comprehensive procedures mentioned above can be followed by users to quickly and accurately create legally compliant GST invoices. Because of the process’s user-friendly design, even people with little experience with accounting may easily navigate it.

Make your Tally more efficient by hosting your version of Tally on cloud. For Free Tally Prime on Cloud Live Demo or details about Tally on Cloud prices visit Tallystack Today.

Frequently Asked Questions

Q. 1 What should I do if I enter the wrong GST rate in an invoice?

You can edit the invoice by navigating to the ‘Vouchers’ section, selecting the invoice, and pressing ‘Enter’ to edit. Correct the GST rate, and save the changes.

Q. 2 Can TallyPrime handle multiple GST rates in a single invoice?

Yes, TallyPrime can handle multiple GST rates. When you add different items to an invoice, TallyPrime calculates and applies the correct GST rate for each item separately.

Q. 3 How can I set up GST rates for new products in TallyPrime?

Go to ‘Gateway of Tally’ > ‘Inventory’ > ‘Stock Items’ > ‘Create’. Enter the product details and specify the GST rate under the ‘Tax Rate’ section.

Q. 4 Is it possible to generate GST reports in TallyPrime?

Yes, you can generate various GST reports in TallyPrime by going to ‘Gateway of Tally’ > ‘Display More Reports’ > ‘GST Reports’. Here, you can access GSTR-1, GSTR-2, GSTR-3B, and other reports.

Q. 5 What if I need to issue a revised GST invoice?

To issue a revised invoice, create a new invoice with the correct details and reference the original invoice number. Note the reason for revision in the invoice notes to maintain clear records.